In the context of increasingly developed finance and increasingly diverse banking services, choosing the right bank becomes an important factor for individuals and businesses. Each bank not only provides basic financial services but also expands to many special services to meet the needs of customers. However, not all banks provide the same services with the same quality and value. Therefore, comparing banks and their services will help users choose the bank that best suits their financial needs and goals. This article will help you better understand the factors to consider when comparing banks and their services.

1. BASIC AND ADVANCED BANKING SERVICES

Each bank provides basic services such as opening a payment account, making a savings deposit, borrowing money, and paying bills. However, each bank has different implementation methods and incentives for each type of service.

Opening a payment account: This is a basic service that every bank provides. However, banks may have different requirements for service fees, minimum balances and flexibility in withdrawing money from the account. Some banks now offer free payment accounts or reduced service fees for new customers.

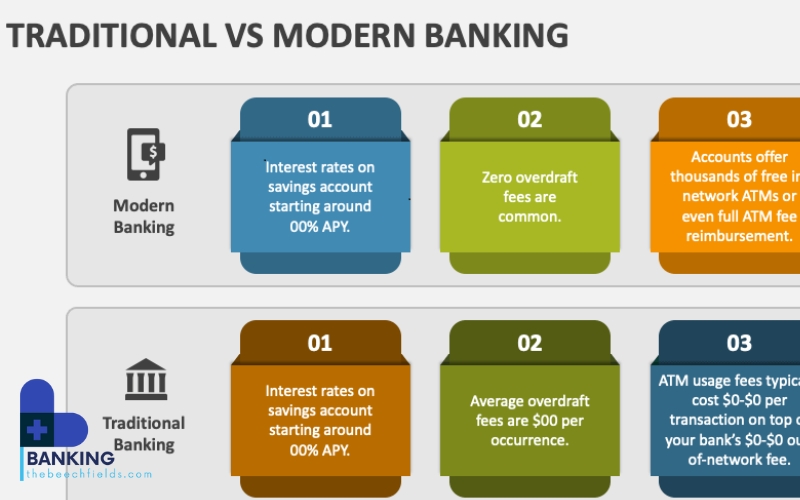

Savings: Bank savings products can be very diverse, from term savings, non-term savings to online savings. Each bank will have different interest rates and conditions for savings, so comparing interest rates of banks will help customers make the best choice.

Unsecured loans and mortgage loans: Most banks offer loans for personal or business purposes. However, loan interest rates, loan term incentives and loan conditions vary greatly between banks. Understanding loans will help you choose the bank that best suits your financial needs.

In addition to basic services, banks also provide more advanced services to meet the increasing needs of customers. For example, insurance products, securities investment services, foreign exchange transactions, credit card services or financial services specifically for businesses. These services may have different fees, and the level of flexibility in using the service will be the deciding factor when customers choose a bank.

2. ONLINE PAYMENT SERVICES AND DIGITAL BANKING UTILITIES

One of the important factors when comparing banks today is the ability to provide digital banking services and online payments. With the strong development of technology, banks not only provide counter transaction services but also expand payment services via the internet and mobile applications.

Mobile banking applications: Most banks today have developed mobile applications so that customers can perform transactions such as money transfers, bill payments, savings deposits, loans and account balance checks right on their phones. However, the quality of these applications is not the same for all banks. Some banks provide applications with user-friendly, easy-to-use interfaces, while others have less flexible and difficult-to-use applications.

QR code payments and fast money transfers: All banks provide QR code payments and fast money transfers, but the transaction processing speed and popularity of QR payment services at stores and businesses vary between banks. Some banks provide instant money transfer services 24/7, while some banks have slower processing times.

Digital Banking: Some banks have now converted to a completely digital banking model, without traditional branches. These banks offer comprehensive online banking services with features such as opening accounts online, applying for loans online, buying and selling stocks, and investing via digital platforms. Digital banks often have the advantage of low costs and fast transactions, but sometimes have limitations in customer service and the ability to directly support problems.

3. BANK CARD SERVICES AND PROMOTIONS

Bank cards are one of the important services that consumers often use. Comparing bank cards and their promotions helps users choose the right product for their needs.

Credit cards: Banks all offer credit cards, but not all banks offer attractive promotion programs. Each bank will have different interest rate policies, from preferential interest rates in the first few months to cashback programs, points accumulation or gift programs. Some banks also offer credit cards with high limits, easy to use in international transactions.

Debit card: Debit cards are a popular type of card used to withdraw money from accounts or make online payments. Banks often offer a variety of debit cards with additional features such as online transaction protection, free withdrawals at other banks’ ATMs, and support for automatic payment services.

Prepaid cards: These are cards that do not have a credit limit and you have to load money onto the card before you can use it. Banks also offer prepaid cards for people who do not want to use a credit card or want to manage their spending more easily. However, the fees for using a prepaid card can be higher than credit and debit cards.

4. QUALITY OF CUSTOMER SERVICE

Customer service is an important factor when comparing banks. A bank with friendly, professional staff who are able to resolve issues quickly will provide a good customer experience. Banks today also offer a variety of customer support methods, from phone calls, emails to live chat via mobile apps.

However, not all banks provide good customer service. Some banks have long response times or are unable to resolve urgent issues, which can affect customer satisfaction.

CONCLUSION

Comparing banks and their services is a necessary and important task for every customer. Each bank has its own strengths and weaknesses, so choosing the right bank will help you optimize costs and benefit from convenient banking services. Considering factors such as interest rates, service quality, online payment facilities, bank cards and customer service will help you make the right decision for your financial needs.